Zillow

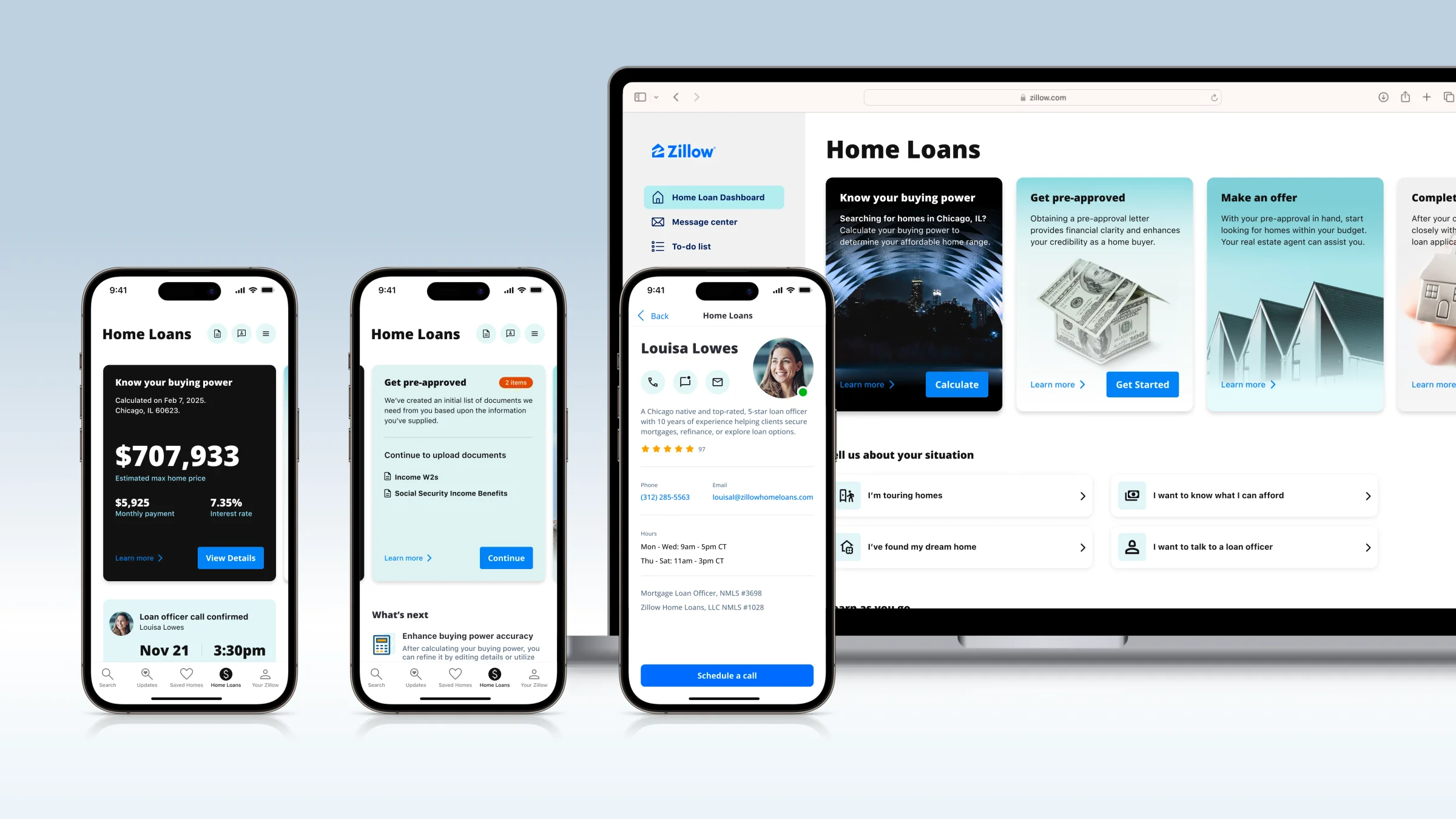

Home Loan Dashboard

UX, Finance, Real Estate, Mobile App, Web Site

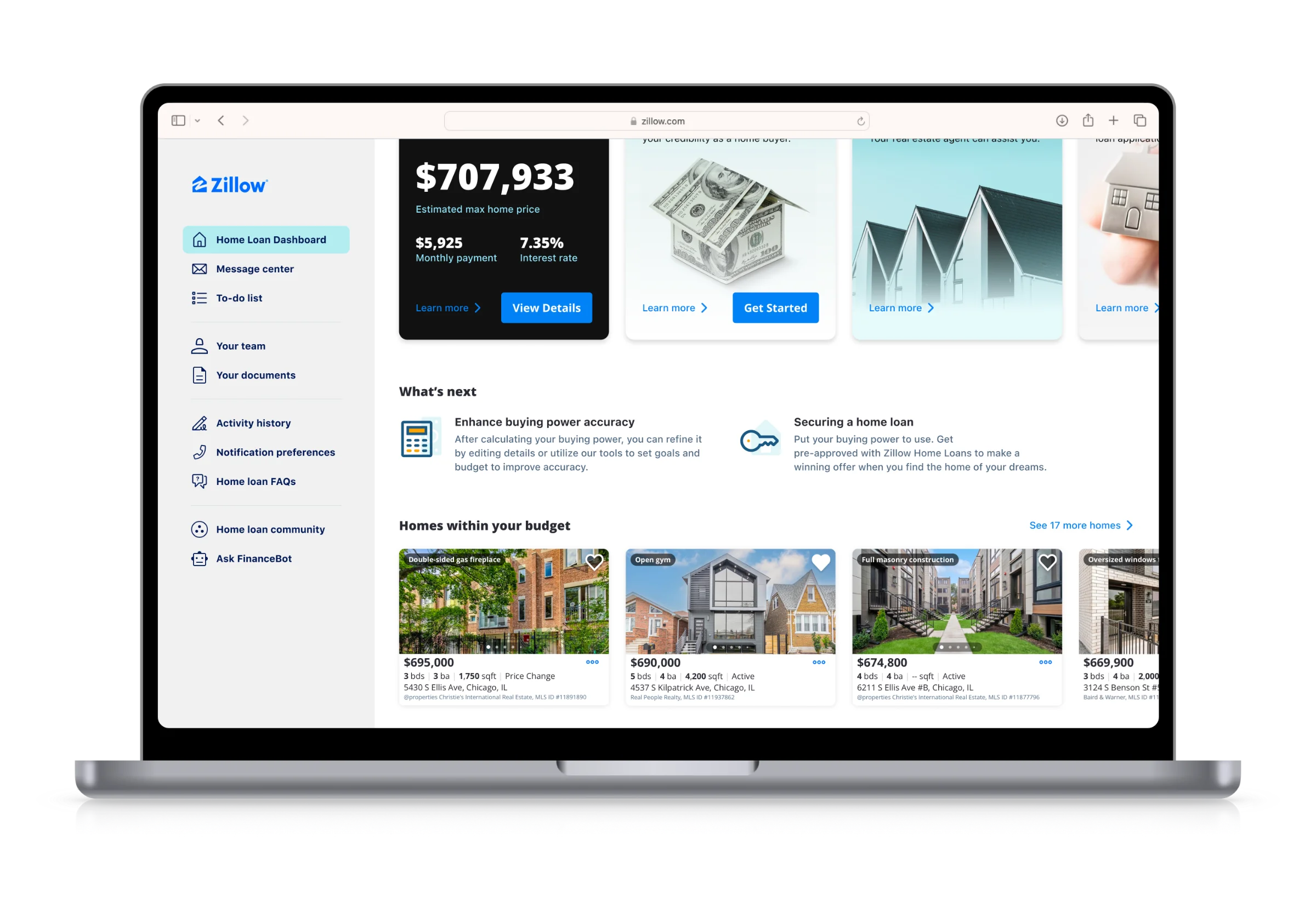

Reimagining Home Financing: A User-Centric Transformation

The Background

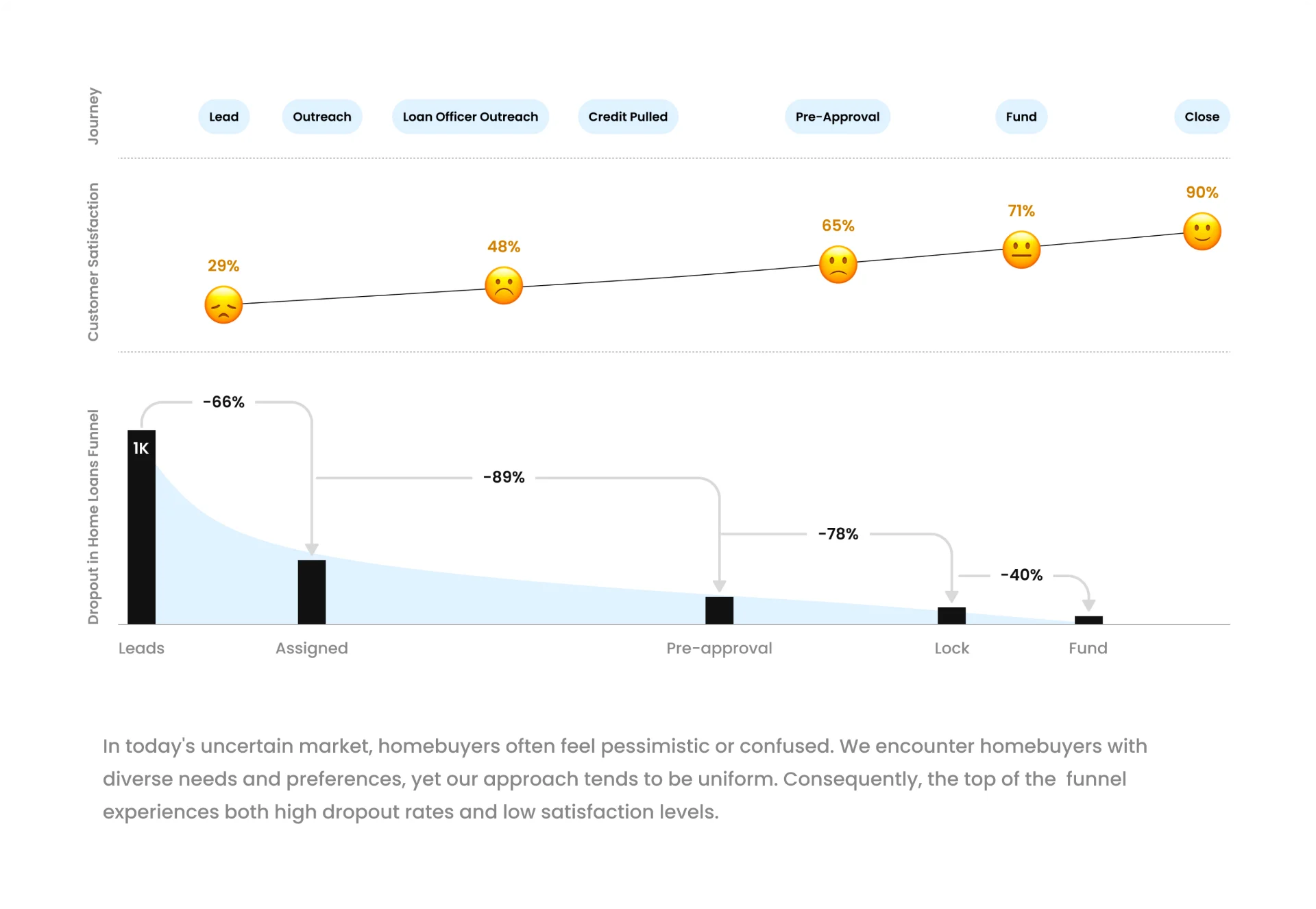

In 2022, Zillow ventured into the home loan market with an ambitious vision – empowering homebuyers to navigate the complex journey of financing with ease and confidence. However, the much-anticipated surge in applications and approvals failed to materialize, primarily due to slow adoption rates and low awareness of the new offering. It was a pivotal moment that called for decisive action.

As the newly appointed Director of Product Design, I assumed a clear mandate: to build and lead a growth team laser-focused on addressing these challenges head-on. My role was to lead the charge of a fresh design strategy that would not only tackle the hurdles hindering adoption but also elevate the user experience far beyond the constraints of traditional mortgage financing processes.

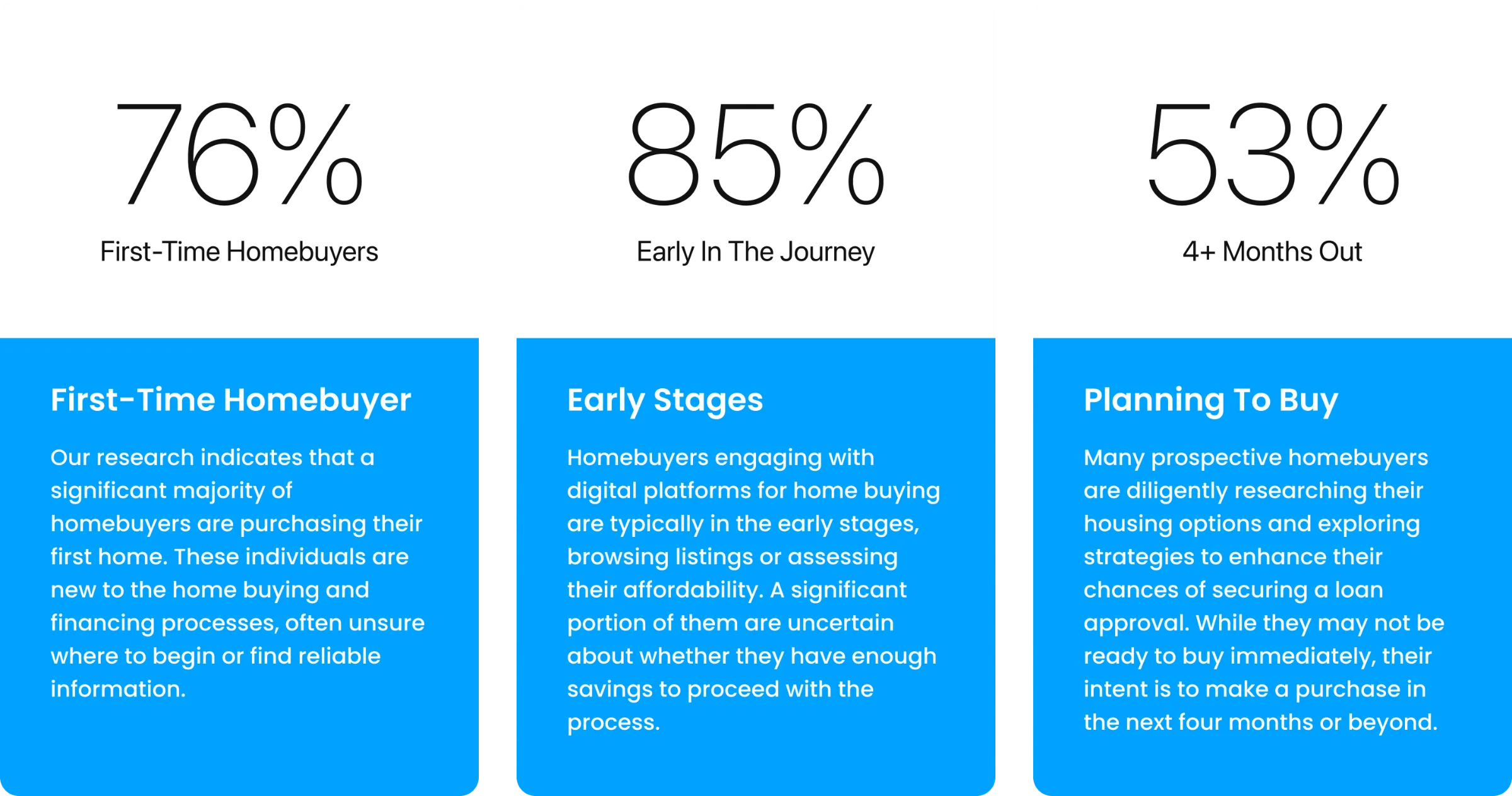

User Problems

Lack of Clarity in Buying and Financing Process: Many first-time homebuyers struggle with the absence of a clear roadmap for purchasing and financing a home, unsure where to begin or what steps to take next.

Navigating the Digital Jungle: Additionally, diving into the online world proved to be quite the adventure for users. Since this product category is still fresh, finding the right info wasn't as easy as pie. With so much to sift through, folks often felt overwhelmed, like they were lost in a sea of options. All this decision-making led to fatigue and left them feeling less than satisfied with their shopping experience.

Confusion Regarding Terminology and Process Steps: Homebuyers often feel overwhelmed by the terminology used in the home buying process and are unsure about the meaning of different steps, leading to confusion and uncertainty

Frustration in Information Retrieval: Homebuyers often find themselves navigating a maze-like search for the information and resources they need, leading to frustration and inefficiency in their home buying journey.

The Strategy

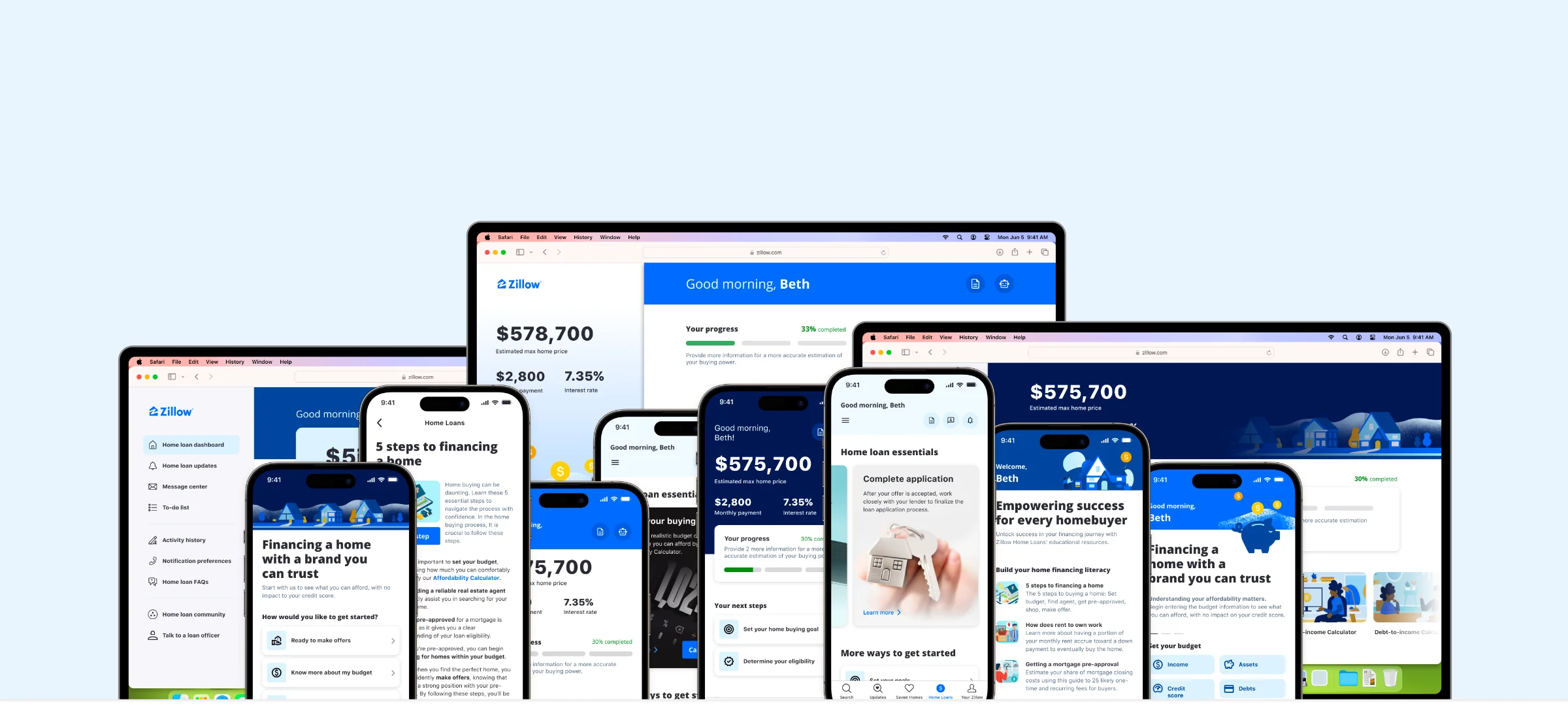

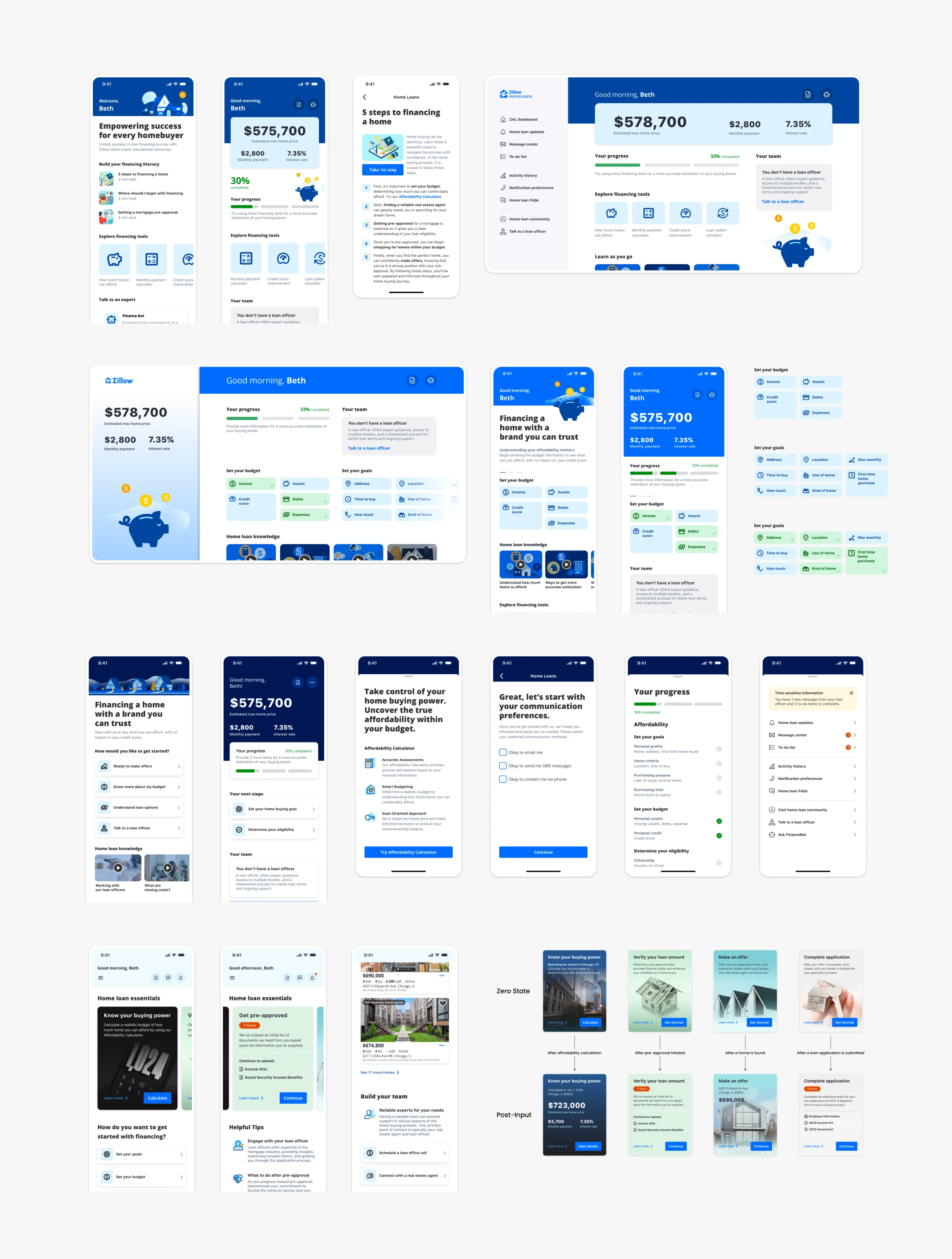

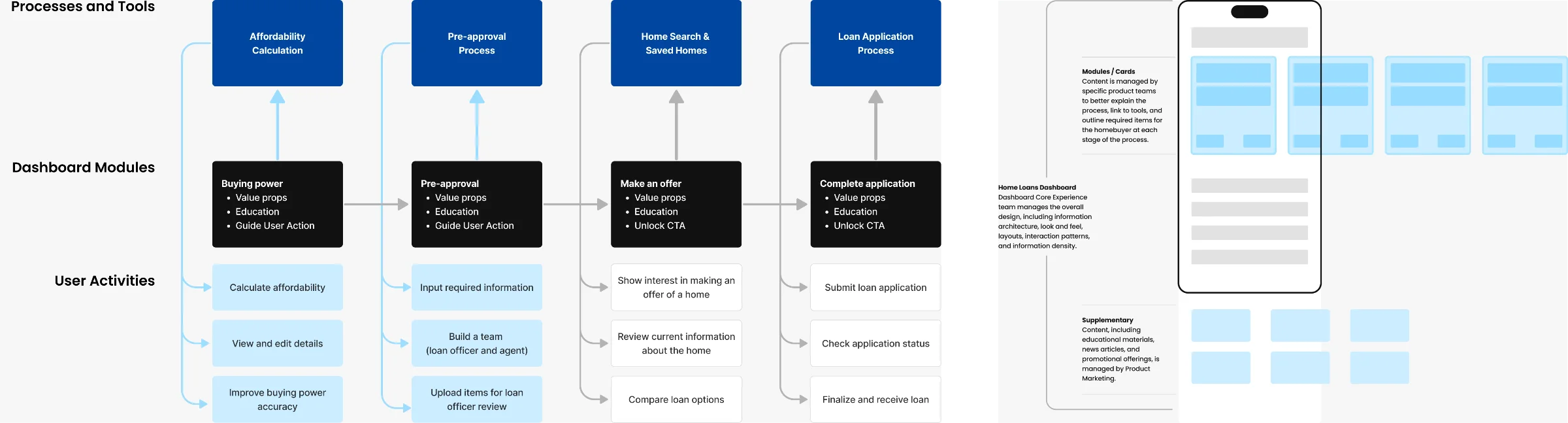

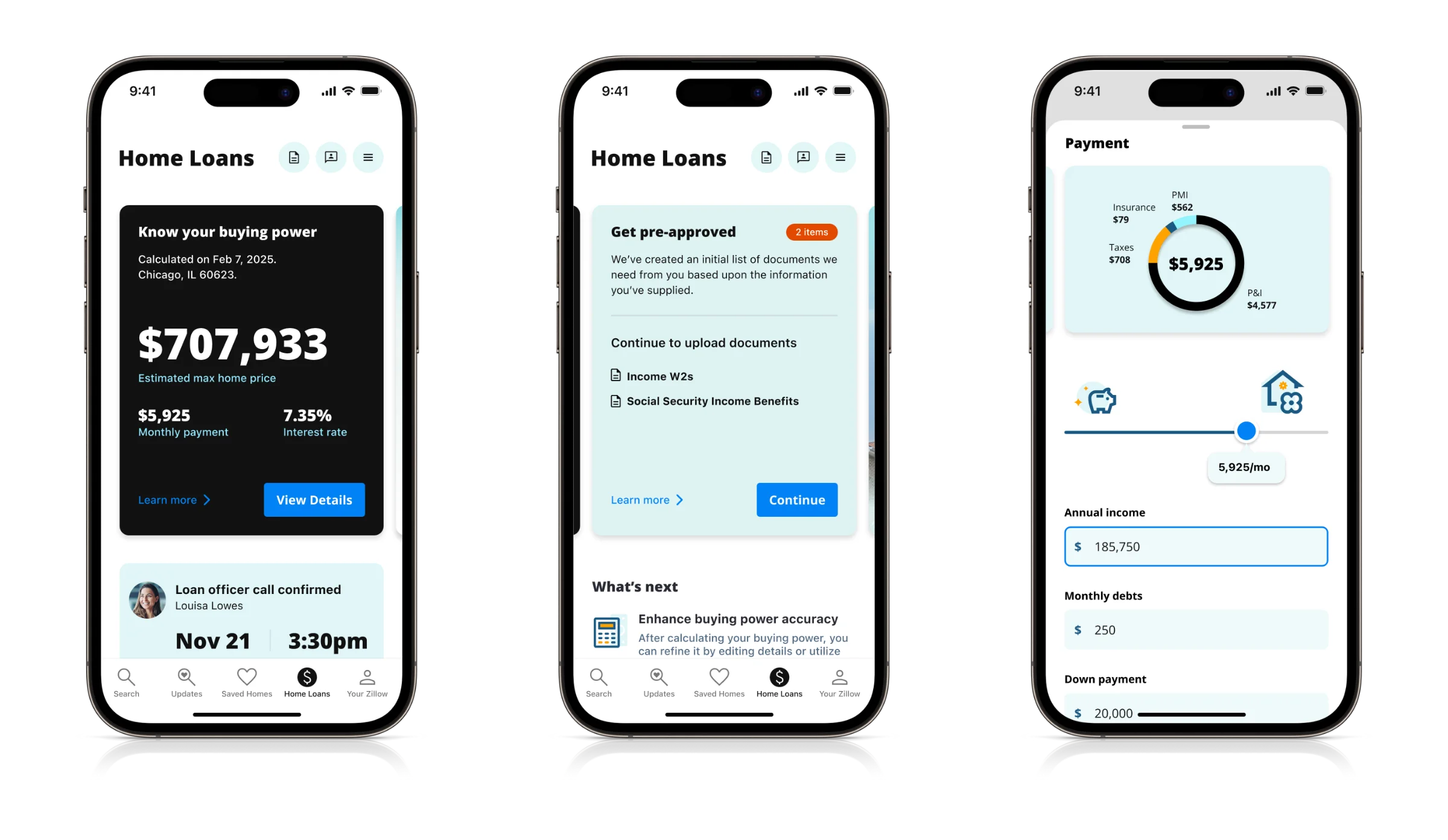

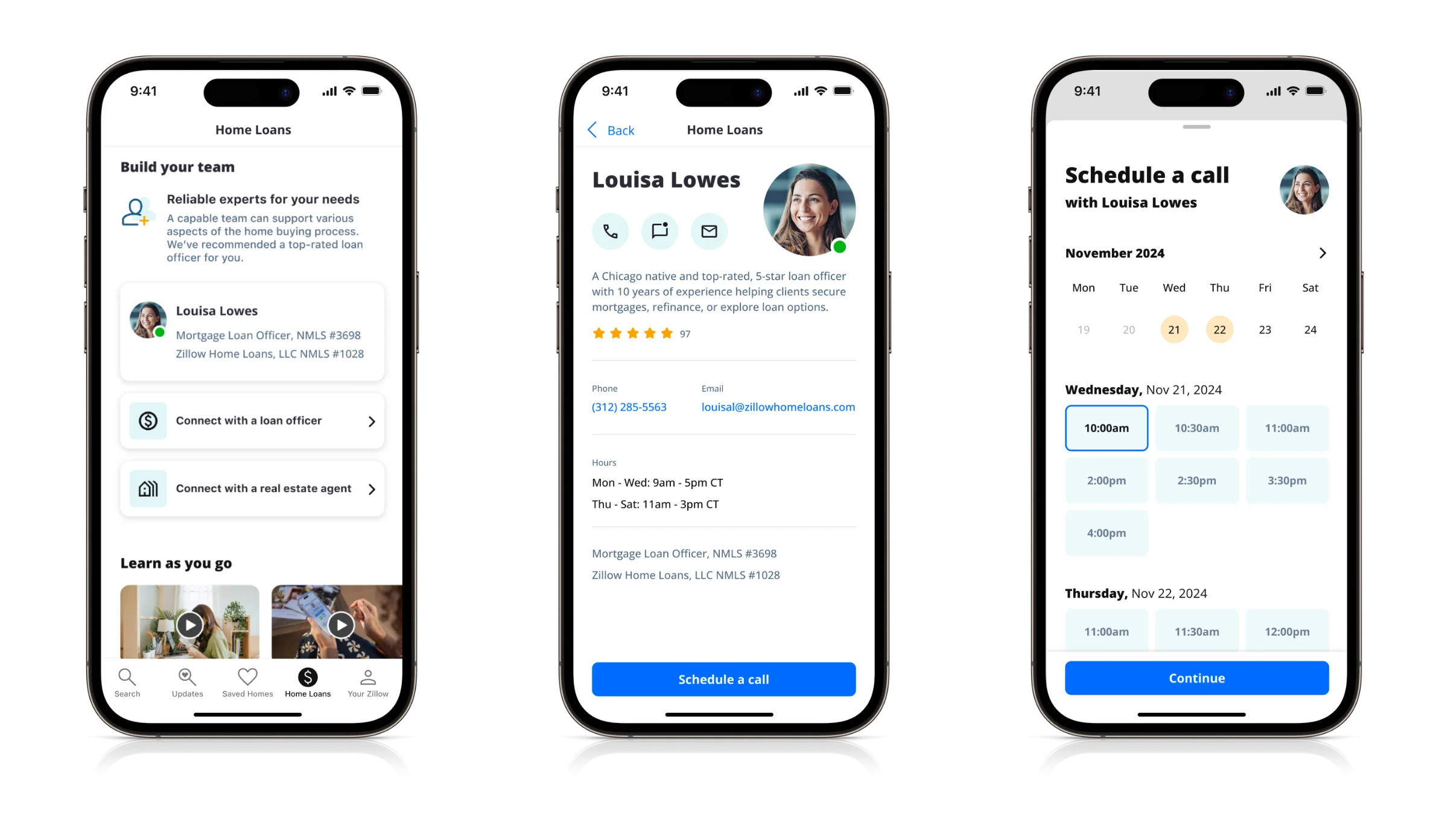

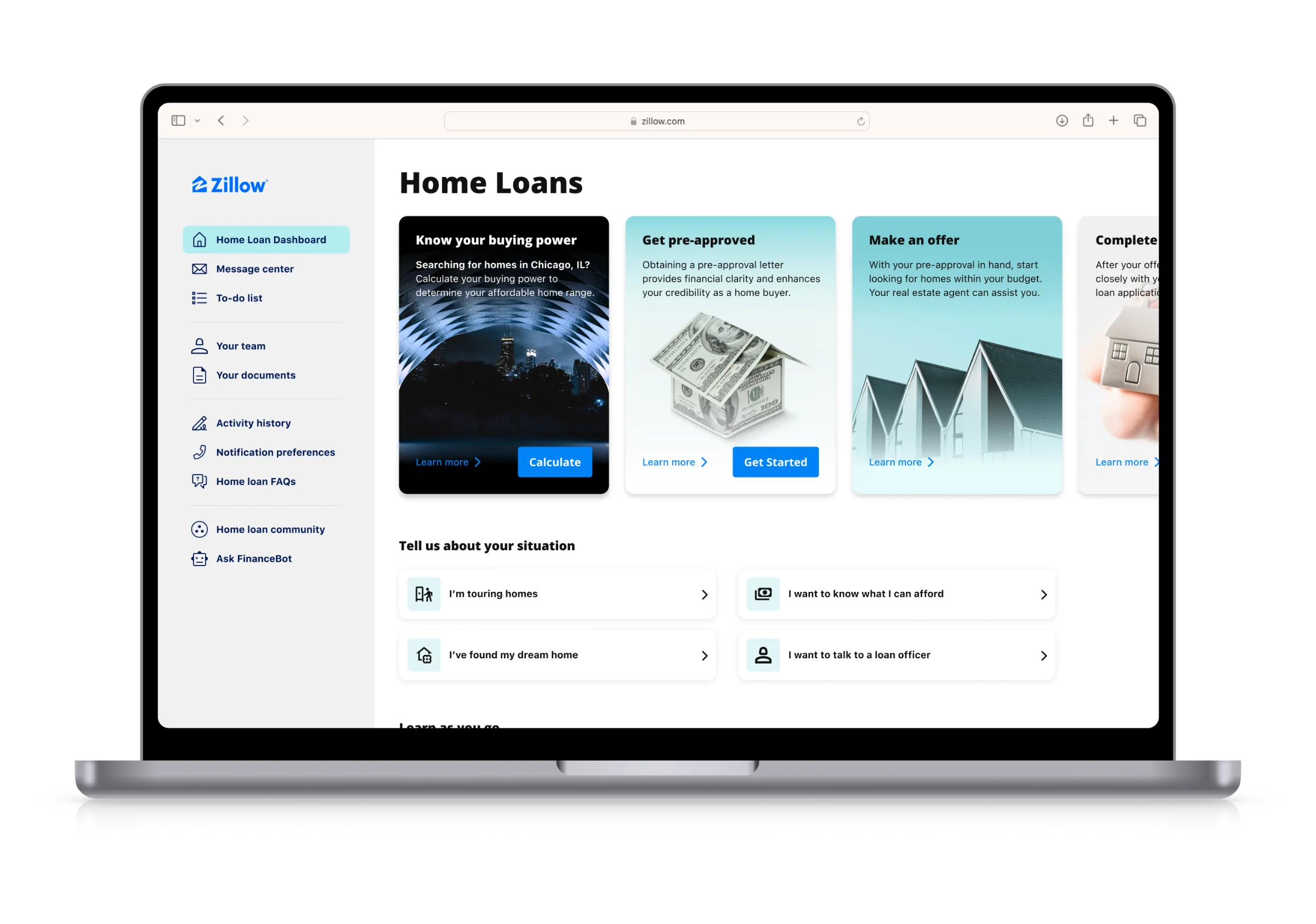

Our strategy centered around crafting an end-to-end experience that would empower homebuyers with a centralized platform to educate themselves, stay abreast of industry developments, initiate the process seamlessly, and confidently pursue their homeownership aspirations. We envisioned a transformative solution that would redefine the way consumers approached and experienced home financing.

Executional Excellence Through Collaboration

Within my first 30 days, I took the initiative in crafting a comprehensive plan that outlined our approach and delineated the necessary activities. Fostering collaboration across cross-product teams, including affordability and qualification, home shopping, authentication, and home loan support, ensured a cohesive and synergistic approach to enhancing the overall user experience.

Recognizing the knowledge gap in this nascent product area, I proactively engaged with marketing insight researchers, user researchers, product leaders, and loan officers, amassing valuable user insights to inform our vision project and navigate resource constraints in user research.

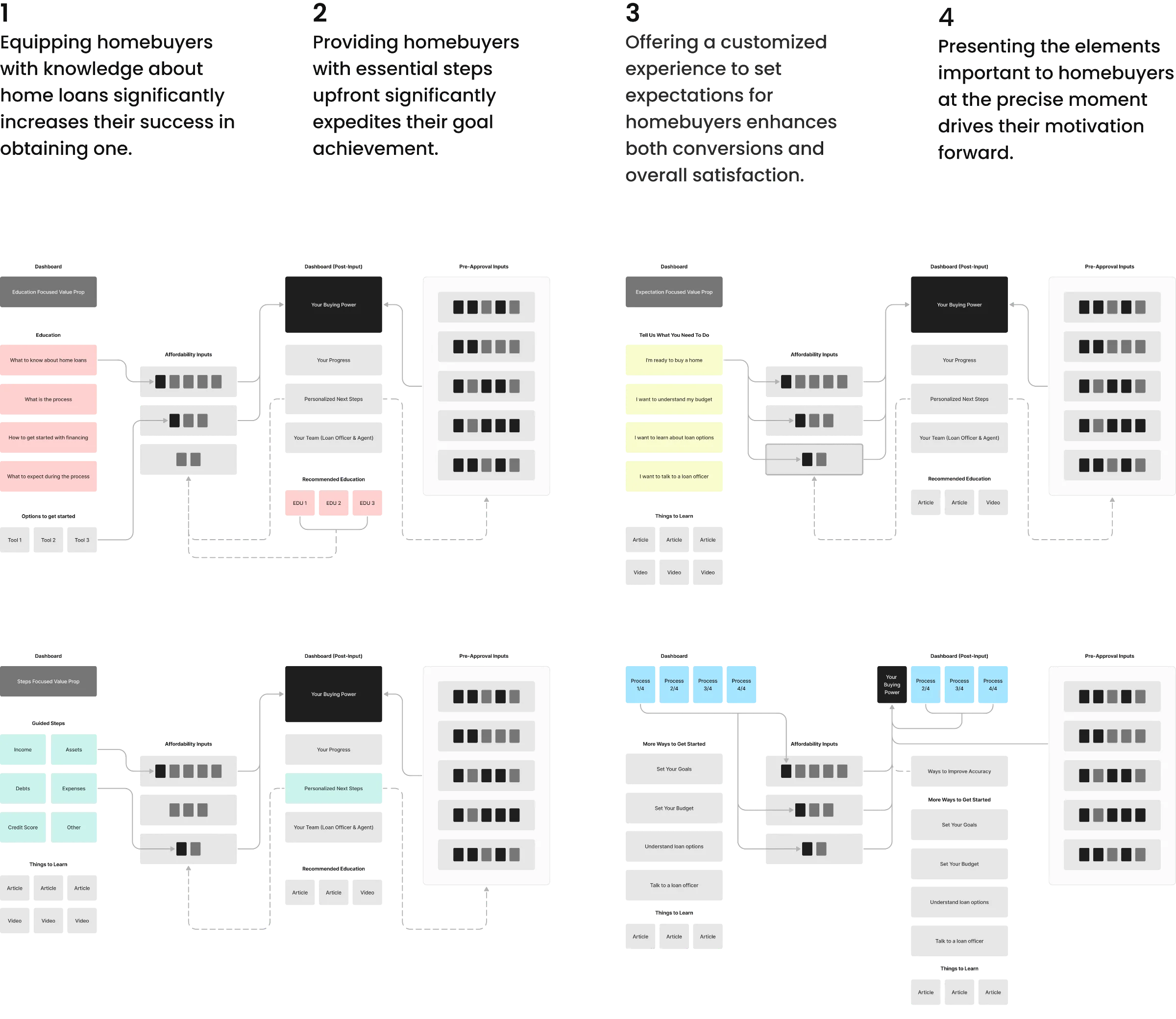

Through an in-person design sprint and follow-up virtual workshops, we fostered alignment among teams, generated a wealth of ideas, and swiftly reached consensus on the initial vision. Prototypes were developed for executive endorsement and user testing, ensuring our solution resonated with the needs and expectations of homebuyers.

Outcomes and Impact

Employing strategic design methodologies and prioritizing a user-centric approach, our team formulated four key hypotheses for evaluation and further feature definition to guide our product and design roadmaps. This endeavor unveiled over 50 improvement opportunities spanning the entire home financing journey, from initial awareness to loan approval.

Furthermore, I played a pivotal role in instilling a design-led ethos within the product team, advocating for elevated user experiences and setting a high bar for design excellence. This initiative fostered a culture of innovation through visualization, prolific exploration, and rapid learning, ensuring that every interaction reflected our commitment to exceptional user experiences.

Challenges: Overcoming Obstacles with Resilience

The path to transformative change is rarely without its challenges, and our vision project was no exception. Despite its resounding success and overwhelmingly positive outcomes, we navigated numerous hurdles within a constrained timeframe, requiring tenacity, resilience and adaptability.

Navigating Resource Constraints: Resource scarcity presented a formidable obstacle from the outset. Tasked with establishing a brand-new design team, I found myself severely understaffed, juggling the dual responsibilities of directorial oversight and hands-on design tasks. The project's demands for high output and agility were far better suited for a full-fledged team of designers, intensifying the pressure on our lean resources.

Rocking the Boat: Introducing a new design process proved to be a significant undertaking. Our collaborators were deeply entrenched in antiquated methodologies characterized by siloed workflows and rigid frameworks that lacked visual inspiration. The recurrence of disagreements, slow responses to novel ideas, and ineffective cross-functional alignment were common challenges within the existing design process. To address this, I assumed a leadership role, initiating a deliberate overhaul. Emphasizing the importance of visualization, iterative refinement, and inclusivity, my efforts aimed to catalyze a paradigm shift in how design was approached within the organization. While this transformation opened new perspectives for many, it necessitated a courageous departure from ingrained practices deeply rooted in the team's culture.

Consumer-Centric Philosophy: Perhaps the most significant hurdle was shifting the prevailing mindset towards a consumer-centric approach. Despite encountering beliefs among my peers that financing products should overwhelm users with extensive data, I championed an intuitive design flow emphasizing progressive discovery and guidance. My focus was on distilling essential information to be clear and concise, reducing cognitive overload for our users. Additionally, I advocated for implementing a lightweight mechanism tailored to first-time users, enabling easy access to information about their affordability thresholds. This shift towards prioritizing user experience at every interaction with our product not only improved usability but also questioned long-held assumptions within the organization.

Through proactive leadership, determination, and a commitment to continuous improvement, we navigated these challenges, emerging stronger and better equipped to deliver exceptional user experiences.

Contribution

Design leadership

Design strategy

Stakeholder interviews

Design sprint facilitation

Workshop facilitation

Work flow design

Product definition

Feature definition

Interaction design

Visual design